This story was originally published here.

American retail sales soared 17.7% in May – the biggest monthly jump ever. That added some “oomph” to a stock market rally that had been, frankly, a little on the tepid side.

The jump was driven in large part by thousands of retail stores and restaurants reopening after months under lockdown; stimulus checks and tax refunds gave consumers a bit more firepower than they might have otherwise had under the circumstances.

But the thing is, the future – not just of retail but the entire economy – is very much uncertain right now. Even though, after going through the initial “coronavirus crash” in March, investors seemed to shrug off the pandemic and all its economic destructiveness in April and May.

Since then, we've seen states reopen their economies and people begin to reemerge into the world to resume their daily lives. As the weather improved apace, people began crowding stores, beaches, and parks. Judging by images in the news, all too often that was happening without masks or distancing.

And now, we're seeing some troubling signs that COVID-19 infections are surging in places like Texas, Arizona, California, and Florida – some of the biggest state economies. Ominously, Arizona's largest hospital system recently warned that it is on track to run out of intensive care unit (ICU) beds soon.

Whether you want to call it a “second wave” or whether it's just a new phase of the first wave, COVID-19 cases are rising in some places that were initially spared this winter.

That's provoked a psychological one-eighty among investors. They're suddenly very concerned with the pandemic's progress, so much so that they sent the big indexes tumbling by high single digits last week in the biggest losses since March.

That disconnect – the contrast between a piecemeal public approach toward masks, social distancing, and other virus containment measures and the markets' sudden concern over new infections after months of ignoring them – is in fact a “Reality Gap” that we can leverage for big profits this week.

Editor's Note: Click here for the full story.

Top Cannabis Investors Reveal Their Plan For 1,000% Returns In 2020

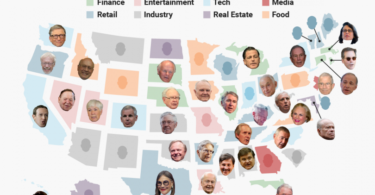

He's backed some of the most successful startups in the world – investing in companies like Dropbox and Pinterest long before they became the giants they are today.

But even with those billion-dollar companies in Joe Montana's portfolio…

He says the cannabis industry has as much potential than anything he's seen in a while.

“It is a great time for investing in the cannabis industry,” he said. “The possibilities to get in on the ground floor of some great companies is very exciting for everyone.“

However, Joe is careful to say the normal rules of investing don't apply to the cannabis market.

“You can't use those old-fashioned metrics analysts tend to lean on. You need a different process.“

Joe wants to make sure Americans have all the information and tools they need to make smart investment decisions.

That's why he recently took part in the The 2020 American Cannabis Summit.

The summit is a gathering of the industry's top experts where they'll reveal the market's best wealth-building opportunities.

And Joe will even go over a unique formula for finding startups.

This online-only event is a must-watch for anyone who has ever considered investing in cannabis.