The history of The Macerich Company (NYSE:MAC) has been quite tough and it can be characterized by moments of significant price appreciation and several instances of long-term value destruction.

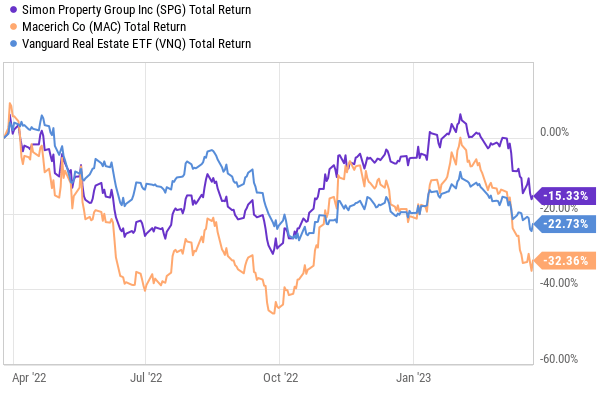

Simon Property Group (SPG) is a direct competitor to MAC with similar portfolio strategy investing in trophy mall assets and pursuing relatively ambitious growth agenda. However, SPG's track record has been completely opposite to that of MAC as can be seen in the graph below.

Looking at the past 5-year period, we can see how MAC has disappointed investors and delivered lower returns by ~67% compared to those of SPG.

While one of the main reasons for the MAC's lagging performance has been a significant issuance of additional shares, the underlying drivers were the following:

- Highly indebted balance sheet with limited headroom for incremental borrowings. For instance, at the beginning of 2021 right before the sizeable share issuance package was launched, MAC's debt/EBTIDA ratio stood at 9.8x which was almost double of what SPG had in the same period.

- Consistently elevated FFO payout ratio making it more challenging for MAC to deleverage and fund new growth projects in financially sustainable manner

- The outbreak of COVID-19, which caused a major shock for retailers across the board, inflicting a considerable damage for retail property owners with weak balance sheets such as MAC.

Since the massive dilution event, MAC has clearly optimized its capital structure by paying back a portion of its debt, reducing dividends and recycling some of the non-core assets.

The market, however, has not bought the story yet as MAC's share price has continued to underperform even after the restructuring.

The ~33% drop in share price over the trailing twelve-month period has taken place despite an outstanding NOI growth of 7.5%, further debt reduction of ~ $160 million and a resilient FFO guidance for 2023.

Now the question is whether one should believe MAC's ability to redeem itself amid uncertainties in the macro world. To answer this question, it is critical to understand whether MAC's capital structure and underlying cash flow generation are strong enough to withstand increasing interest costs and potential headwinds in the retail space.

Solid topline with a slight upward momentum

In 2022, MAC achieved same-center NOI growth of 7% for the second straight year in a row. This has strengthened the comparable base in the NOI figure that will be difficult to beat in 2023.

The Management's guidance for the NOI growth in 2023 is between 2 and 3% that is primarily based on a sizeable amount of pipeline deals opening and paying rents. The net effect on the NOI is estimated at $55 million of which the majority will start to be recognized at the end of 2023.

The FFO guidance for 2023 is between $1.75 and $1.85 per share. This translates to a decreased ~ $0.15 of FFO per share on a year-over-year basis. The main explanation lies in an estimated decline in lease termination income from $25 million in 2022 to a $10 million in 2023 that is more in line with the historical averages.

In a nutshell, there are three reasons why I am confident in the stability of MAC's future FFO:

- Even in 2022, which was a year of uncertainty putting a serious downward pressure on the consumers' confidence, MAC increased its sales by 13% over 2019 level and captured ~95% averaged traffic of pre-pandemic levels.

- In 2022, MAC experienced a record-setting leasing activity by opening 270 new and fully booked stores.

- There were only four bankruptcies in 2022 reflecting a much more robust tenant base, which has gone through a strong filtering process during the pandemic.

Abundant liquidity coupled with robust debt service coverage

As of Q4, 2022, MAC had $512 million of available liquidity, which is sufficient to theoretically cover all of the maturing debt or all cash expenses in 2023.

On January 2023, MAC successfully signed a new $370 million debt financing deal to rollover the previous debt associated with Green Acres Mall and Green Acres Commons. There are no indications in the debt financing markets that finding fresh liquidity for class A malls owners would be a problem.

The new financing was closed at 6% fixed interest rate, which gives a reasonable ballpark estimate of where the weighted average interest rate for MAC could be headed assuming that the monetary policy remains relatively constant.

In 2022, MAC's weighted average interest rate stood at 4.6%. Also, in the form 10-K filling, the Company estimated that a 1% increase in interest rates would decrease its cash flows by approximately $7.9 million based on $791.4 million of floating rate debt outstanding at December 31, 2022. Making a quick back of the envelope math, where the same relationship is applied to the total consolidated outstanding debt and assuming a weighted average interest rate convergence to 6%, the total annual incremental interest costs would amount to ~$61 million ($0.27 per share).

Against the backdrop of average estimated FFO in 2023 (~$400 million) and an assumed development activity at exactly same levels as in 2022, MAC would be left with approximately $210 million of available funds for distribution or new investments. Compared to the current dividend level, MAC would still be able to safely service the quarterly distributions, while keeping $71 million in the books.

Obviously, such an immediate and direct effect on the interest cost component is only theoretical and in practice it will occur gradually over ~ 3 year period based on the weighted average maturity profile.

Meanwhile, we can expect a steady deleveraging process from MAC, which will eventually offset some of the negative effects from raising interest costs. The estimated net debt / forward EBITDA reduction is from 8.8x in 2022 to 8.4x in 2023.

Lastly, an important element, which should be appreciated is an extremely conservative FFO payout ratio. Considering the mean value of FFO guidance for 2023 and a quarterly dividend of $0.17 per share, the FFO payout ratio lands at just 37%. Hence, there is a huge wiggle room for MAC to absorb an uptick in the interest costs and still undertake profitable reinvestments at the same time directing a part of the available funds to debt reduction activities.

The bottom line

At the current share price of $9.5, MAC trades at a 5.2x multiple based on average consensus FFO estimate. This is a 38% discount to SPG's multiple based on the 2023 FFO guidance, where the FFO payout level stands at 65%.

Given the resilient fundamentals in the sector and strong cash flows, MAC is a clear buy. While waiting for a normalization of the valuation multiple, investors should feel comfortable in capturing a juicy 7% yield.

Originally published on SeekingAlpha.com

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.